Enhancing Spend Management for Businesses in Kenya with Openfloat by Pesapal

In today’s competitive business environment, controlling expenses and optimizing spend are critical to being successful. However, as businesses increasingly move towards remote and hybrid working models, the need for efficient spend management has become even more important than ever before.

My own business faced this challenge during and after the COVID-19 pandemic, and like many others, I quickly realized that traditional methods of managing company expenses weren’t working for us. Therefore, it was almost by pure blind luck that I stumbled upon Openfloat by Pesapal, a digital spend management solution that has quite honestly completely transformed how we handle business expenses.

The Need for Effective Spend Management

Before adopting Openfloat, managing our business expenses in a remote working context was providing to be a cumbersome and inefficient process. At the time, we relied on manual cash disbursements for day-to-day expenses, using personal mobile money accounts to pay suppliers and other operational costs.

This manual process made it quite difficult to keep track of spending and created gaps in transparency and accountability. It also consumed too much productive time and kept us involved in tasks that were tactical rather than strategic in nature which is never a good idea.

As we transitioned to being a fully remote working organization, the need for a streamlined and digital-first spend management solution became increasingly urgent. Managing employee expenses, supplier payments, and operational costs from a distance meant that we needed a system capable of efficiently tracking, monitoring, and controlling spend at all levels. This is where Openfloat came in.

Discovering Openfloat: A Spend Management Solution

I first learned about Openfloat through billboards I spotted earlier this year whilst driving around in Nairobi, and the messaging immediately caught my attention. The platform promised a way to handle business spend more efficiently by digitizing petty cash, payroll, and corporate bills payments—all within one centralized system. Given our growing reliance on digital payments, I was quite instantly captivated by the idea of using Openfloat to simplify and improve how we managed our business expenses. Let’s just say we were a problem already looking for such a solution!

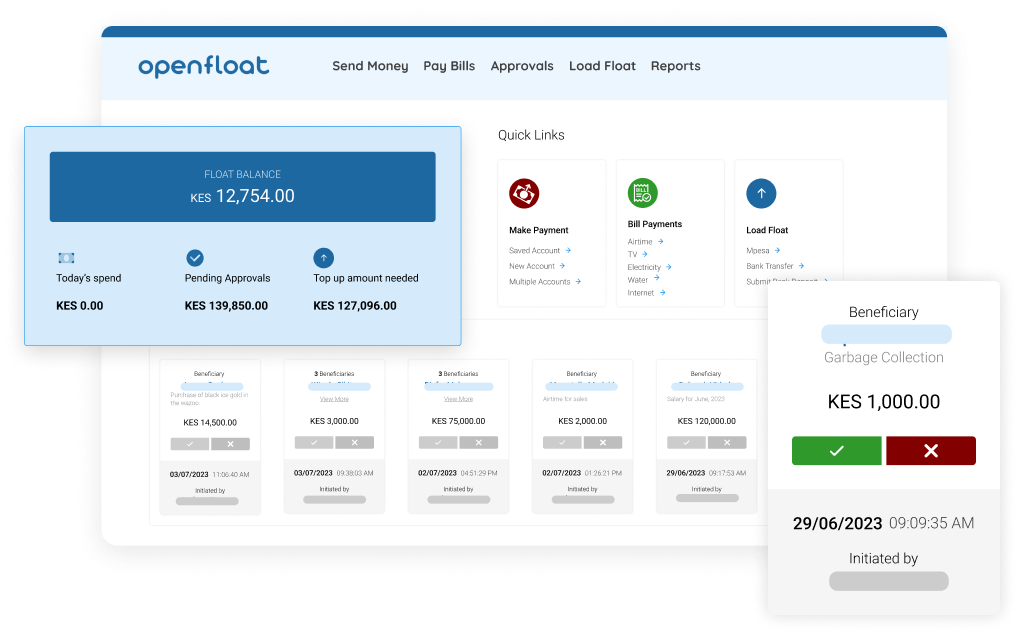

The onboarding process was quite seamless and painless as after providing standard Know Your Customer (KYC) documentation, we were fully operational on Openfloat in a matter of a couple of days as I recall. Thereafter, once we topped up our Openfloat account via bank transfer, we added our Finance Lead to the account, allowing them to manage day-to-day expenses while maintaining oversight through Openfloat’s user management features. The maker-checker process ensures that while they can initiate payments, final approvals rest with me, preserving accountability while decentralizing some control.

Given PesaPal’s solid credentials in Kenya and the rest of East Africa as one of the first digital payments service providers or PSPs with a formidable range of products and services in the market, it made so much sense that PesaPal had launched Openfloat since it complements its diverse offerings in a myriad of ways so signing up was a no-brainer for us.

Simplifying & Optimizing Expense Tracking

One of the most immediate benefits of Openfloat is how it simplifies expense tracking. In the past, reconciling business expenses was a tedious and time-consuming process that involved manually collecting and reconciling digital and physical receipts as well as logging every transaction. This process was prone to human error, not to mention inefficiencies that needed to be eliminated. Openfloat changed that by digitizing and automating the expense management process so much so that I am writing this blog post about it – true story.

Through Openfloat, all transactions became documented in real-time, and the platform provided an organized ledger of every expense, easily. Whether it’s paying suppliers, covering operational costs, or managing employee disbursements, each transaction is automatically captured and makes it super easy to track how money is being spent. This improved visibility into our expenses has been a game-changer for maintaining much better control over spending and freed up time that was spent on mundane but important financial activities.

Openfloat’s grouping and categorization features also allows us to easily track spending by the type of expense being disbursed. This ability to segment expenses gives us better insights into where money is going, helping us make more informed financial decisions in the future. The ability to do this so effortlessly has been quite profound and insightful.

Optimizing Payments & Supplier Relationships

In the past, managing our payments had been a challenge and especially when it came to ensuring timeliness and keeping good relationships with our suppliers. Before Openfloat, these payments were often made manually, which often led to administrative challenges.

At this time, Openfloat ensures that our payments are now handled digitally in a fully automated manner. It allows us to upload bulk payments and disburse them to suppliers instantly—whether via mobile money, bank transfers, or other digital channels. This not only improves efficiency but also strengthens our relationships with suppliers.

Openfloat also provides a full history of supplier payments, enabling us to better understand spending patterns from a data driven perspective which is priceless.

Empowering Employees & Expense Autonomy

Another key feature of Openfloat is how it empowers our team members to manage their own expenses, without sacrificing oversight. For example, our Finance Lead can initiate payments for operational costs—such as utility bills, subscriptions, and employee expenses—without waiting for approval at every stage. This has significantly optimized our operational workflow, while maintaining accountability through the maker-checker or approval process.

User access controls ensure that different employees can be granted specific permissions based on their role within our organization. This means that only authorized team members can make or approve payments, while maintaining the ability to track and audit all these transactions in real-time. Openfloat has enabled a more decentralized approach to managing expenses, allowing team members to act more autonomously while adhering to predefined budget constraints.

Real-Time Spend Analysis & Reporting

A critical part of managing business expenses in any organizational is having access to detailed spend data in real-time. Openfloat’s reporting capabilities now allow us to generate comprehensive reports on all transactions channelled there which can be exported to spreadsheets for further analysis.

This level of visibility into our finances enables us to forecast future spending more accurately and plan budgets accordingly. By analyzing trends in our spending data, we’ve been able to make more strategic decisions.

Enhancing Spend Control Through Corporate Spend Management

Openfloat is a true spend management tool given its ability to handle bulk payments and group transactions. The corporate spend management features allow us to pay multiple bills, purchase airtime in bulk, and even make payroll disbursements, if we wanted to, without the complexity or high transaction fees normally associated with such tasks.

For instance, we regularly disburse mobile airtime and data bundles to employees working remotely, as well as make monthly payments for recurring services such as subscriptions and cloud-based tools. Openfloat enables us to group these expenses, simplifying the payment process and ensuring that all payments are made on time. This has reduced administrative overhead while also helping us stay on top of our recurring financial commitments.

Spend Management for Business Transport.

Openfloat is also important to us for managing transportation expenses as a business that regularly schedules staff transport for client meetings for instance which has made it so invaluable. This is made possible in how all transport bookings and payments are seamlessly integrated into the broader spend management system. This ensures that every expense is tracked and categorized, giving us complete visibility into transportation spend and making it easier to manage these costs.

The Future of Spend Management with Openfloat

Looking ahead, it’s clear that Openfloat will remain an essential part of our financial management strategy. It has streamlined our spend management processes, enhanced accountability, and provided real-time insights into our spending activities which has transformed the way we handle business expenses.

In conclusion, if you’re looking to optimize your business’s spend management processes, I highly recommend giving Openfloat a go. It has made a significant difference in how we manage expenses, and I’m confident it can do the same for other businesses throughout Kenya looking to gain better control over their finances.

Spend Management Simplified

Track Your Expenses Easily With Openfloat

Join our Newsletter for insightful updates and exclusive content.

Blog Page

Related Posts

customer story: 1 minute Read

How Openfloat Transforms Bar Next Door's OperationsBar Next Door (BND) is an iconic hot spot nestled in the heart of Nairobi, Kenya, renowned for its vibrant and electrifying nightlife scene. Situated in one of Nairobi's trendiest neighborhoods, Bar Next Door has earned its reputation as the ultimate destination for partygoers and socialites alike.

Pesapal, we provide customized payment solutions for our merchants. We listen to their needs and create unique solutions to their payment challenges. We offer businesses an accessible, reliable, and cost-effective way to collect money via mobile money, debit,

Pesapal Limited

P.o Box 1179-00606

Nairobi Kenya